|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

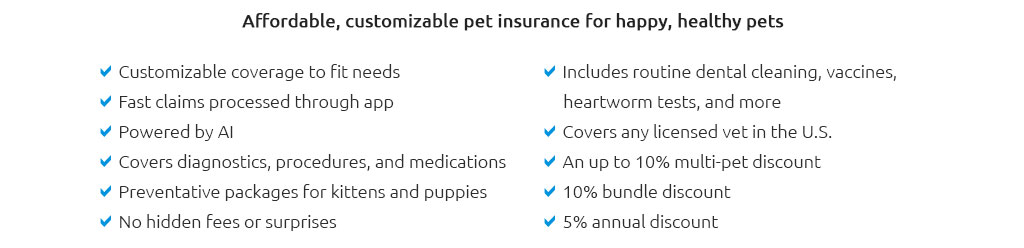

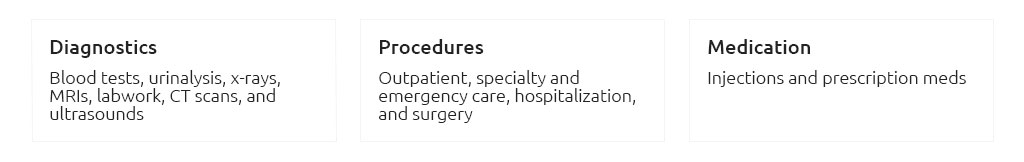

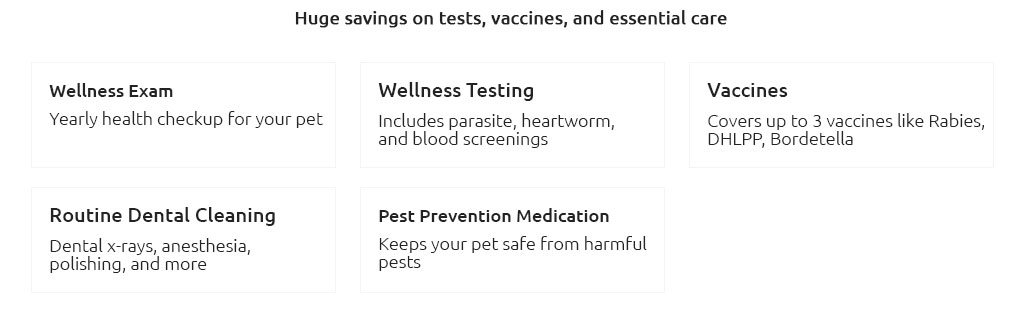

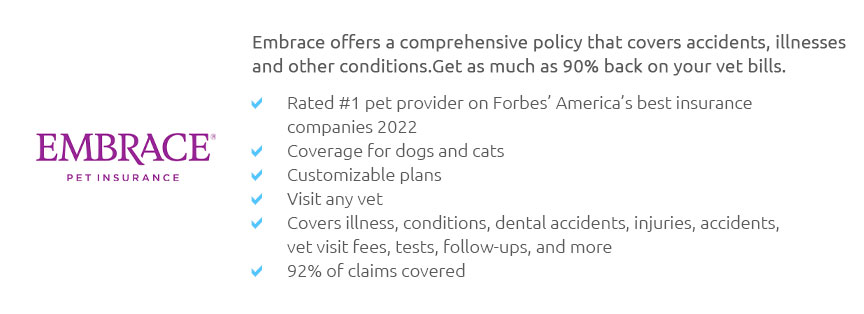

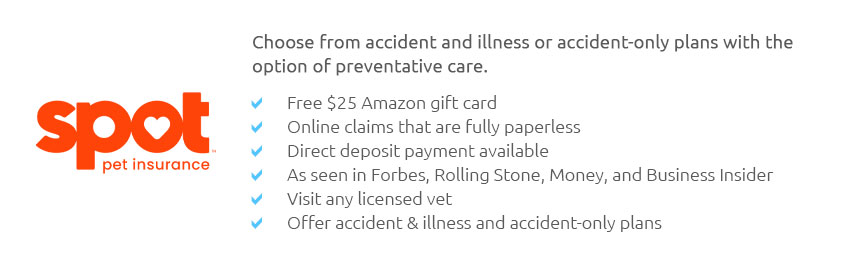

Pet Insurance Renters: A Comprehensive GuideIn today's ever-changing rental market, the concept of 'pet insurance renters' has emerged as a topic of significant interest and importance. As more people choose to rent rather than own homes, the need to protect both their property and their beloved pets has become increasingly apparent. Pet insurance renters-a term that may initially sound peculiar-refers to renters who are not only seeking to safeguard their living spaces but also ensuring that their pets are covered for any unforeseen events. In a world where our furry companions are considered family, understanding the intricacies of pet insurance for renters is essential. For many renters, the bond with their pets is as strong as any familial tie. Yet, when it comes to renting, pet-related issues can often become a sticking point. Many landlords have stringent rules about pets, and even when allowed, the potential costs from damages or emergencies can be daunting. This is where pet insurance steps in, offering a layer of financial protection that goes beyond standard renters insurance. While renters insurance typically covers personal property and liability, it doesn't account for veterinary bills or damages specifically caused by pets. Enter pet insurance-designed to fill these gaps, offering peace of mind to renters. Pet insurance for renters generally covers medical expenses for illnesses and injuries, much like health insurance for humans. Depending on the plan, it may also include coverage for routine care such as vaccinations, dental cleanings, and flea treatments. The benefits of pet insurance are manifold, particularly for renters who might face unexpected costs associated with their pets. It not only alleviates financial stress during emergencies but also ensures that pets receive timely and necessary care without the worry of prohibitive costs. One of the most common misconceptions about pet insurance is that it is an unnecessary expense. However, for renters, this couldn't be further from the truth. The reality is that pet insurance can be a financial lifesaver, particularly when dealing with the unpredictable nature of accidents or health issues. Given the rising costs of veterinary care, a pet insurance policy can often pay for itself with just one emergency vet visit. Choosing the right pet insurance policy requires careful consideration. It's important to evaluate different plans based on factors such as coverage limits, deductibles, and premiums. Renters should also consider the specific needs of their pets, such as breed-specific health issues or age-related concerns. A well-chosen pet insurance plan can provide comprehensive coverage without breaking the bank, making it an invaluable asset for any pet-owning renter.

In conclusion, pet insurance for renters is not just a luxury-it's a necessity. It provides an essential safety net for both renters and their pets, ensuring that unexpected events don't lead to financial hardship. By choosing the right policy, renters can protect their pets and their finances, creating a harmonious living environment for everyone involved. FAQWhat is pet insurance for renters? Pet insurance for renters is a policy that helps cover veterinary expenses and pet-related damages, providing financial protection for renters with pets. Does renters insurance cover pet damages? Typically, renters insurance does not cover damages caused by pets; separate pet insurance is needed for such coverage. Why should renters consider pet insurance? Renters should consider pet insurance to mitigate unexpected veterinary costs and potential pet-related damages, offering peace of mind. How do I choose the right pet insurance plan? Evaluate plans based on coverage, premiums, and specific pet needs to select a comprehensive and affordable insurance policy. Is pet insurance worth it for renters? Yes, pet insurance is worth it as it provides crucial financial protection against unforeseen veterinary costs and pet-related issues. https://www.amfam.com/resources/articles/at-home/renters-insurance-with-dogs

The property damage liability portion of your renters policy may help pay for covered losses up to your policy limit. It's designed to help ... https://www.forbes.com/advisor/renters-insurance/pet-liability-renters-coverage/

Pet-Specific Coverage Limits. Pet liability coverage is included within your overall renters insurance liability limit, which typically starts ... https://www.bankrate.com/insurance/homeowners-insurance/pets-and-renters-insurance/

A renters insurance policy can help if your pet injures someone else, while pet insurance can help with your pet's injuries and medical expenses.

|